Electric Vehicle Tax Credit By Manufacturer . On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue.

from e-vehicleinfo.com

The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. You can claim the credit.

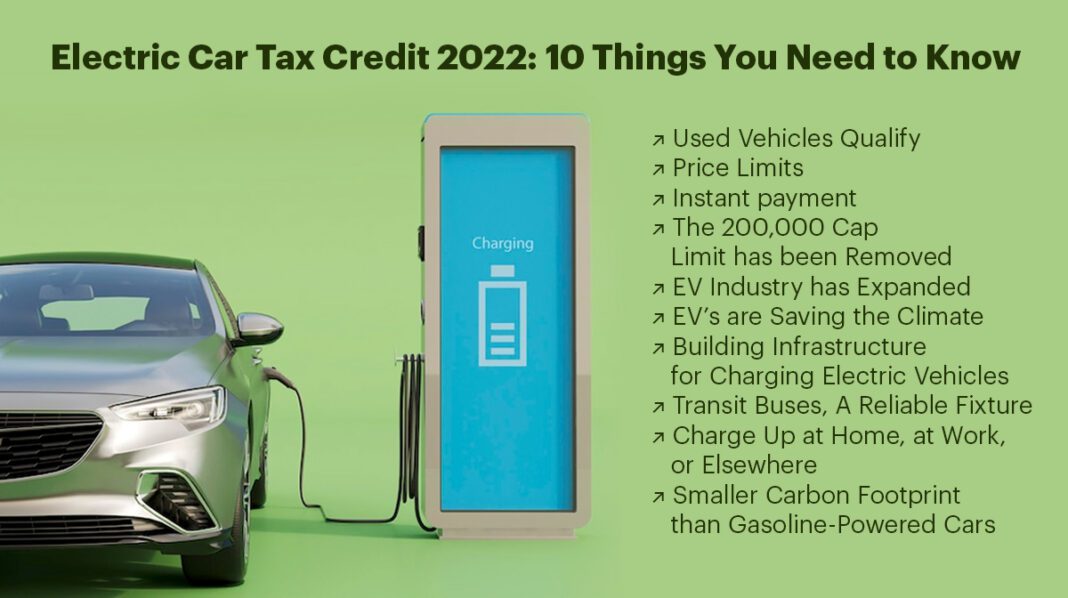

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo

Electric Vehicle Tax Credit By Manufacturer The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. You can claim the credit. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue.

From rideonelectric.com

Which Electric Vehicles Qualify for US Federal Tax Credit 2024? Electric Vehicle Tax Credit By Manufacturer The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for. Electric Vehicle Tax Credit By Manufacturer.

From theadvisermagazine.com

Will I Qualify for the Electric Vehicle Tax Credit Electric Vehicle Tax Credit By Manufacturer A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. You can claim the credit. Tax credits up to $7,500 are available for. Electric Vehicle Tax Credit By Manufacturer.

From autotitling.com

Electric Vehicle Tax Credits What You Need to Know Automotive Electric Vehicle Tax Credit By Manufacturer You can claim the credit. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks to the inflation reduction. Electric Vehicle Tax Credit By Manufacturer.

From kbfinancialadvisors.com

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB Electric Vehicle Tax Credit By Manufacturer On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks to the inflation reduction act. Electric Vehicle Tax Credit By Manufacturer.

From turbo-tax.org

Have A New Electric Car? Don't To Claim Your Tax Credit! Turbo Tax Electric Vehicle Tax Credit By Manufacturer On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Tax credits up to $7,500 are available for eligible new electric vehicles and. Electric Vehicle Tax Credit By Manufacturer.

From comparisonsmaster.com

How To Claim 7500 Electric Vehicle Tax Credit Comparisonsmaster Electric Vehicle Tax Credit By Manufacturer The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for. Electric Vehicle Tax Credit By Manufacturer.

From getelectricvehicle.com

Electric Car Tax Credit Everything that You have to know! Get Electric Vehicle Tax Credit By Manufacturer Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d. Electric Vehicle Tax Credit By Manufacturer.

From www.ubicenter.org

The Inflation Reduction Act discourages electric vehicle buyers from Electric Vehicle Tax Credit By Manufacturer You can claim the credit. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. A federal ev tax credit is here, thanks to the inflation reduction. Electric Vehicle Tax Credit By Manufacturer.

From e-vehicleinfo.com

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo Electric Vehicle Tax Credit By Manufacturer You can claim the credit. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. On april 17, 2023, the irs published a notice of proposed rulemaking requiring. Electric Vehicle Tax Credit By Manufacturer.

From www.emobilitysimplified.com

How does US Federal Tax Credit for Electric Vehicles work? Update on Electric Vehicle Tax Credit By Manufacturer You can claim the credit. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks. Electric Vehicle Tax Credit By Manufacturer.

From dennilurline.pages.dev

Electric Car Tax 2024 Idell Lindsay Electric Vehicle Tax Credit By Manufacturer You can claim the credit. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. Tax credits up to $7,500 are available for. Electric Vehicle Tax Credit By Manufacturer.

From newandroidcollections.blogspot.com

Electric Vehicle Tax Credit News Ev Electrek Money Qualify Electric Vehicle Tax Credit By Manufacturer A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. You can claim the credit. Tax credits up to $7,500 are available for. Electric Vehicle Tax Credit By Manufacturer.

From alloysilverstein.com

Frequently Asked Questions 2023 Clean Energy and Electric Vehicle Tax Electric Vehicle Tax Credit By Manufacturer On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. A federal ev tax credit is here, thanks to the inflation reduction. Electric Vehicle Tax Credit By Manufacturer.

From www.svlg.org

Reform tax credit for electric vehicles Silicon Valley Leadership Group Electric Vehicle Tax Credit By Manufacturer On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. A federal ev tax credit is here, thanks to the inflation reduction. Electric Vehicle Tax Credit By Manufacturer.

From elitetaxplanningservices.com

Electric Vehicle Tax Credit Elite Accounting & Tax Inc Electric Vehicle Tax Credit By Manufacturer The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. You can claim the credit. Tax credits up to $7,500 are available. Electric Vehicle Tax Credit By Manufacturer.

From randybanallese.pages.dev

Electric Vehicle Credits 2024 Dorice Sharlene Electric Vehicle Tax Credit By Manufacturer You can claim the credit. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. The inflation reduction act of 2022 (ira) makes several changes to the tax credit provided in section 30d of the internal revenue. Tax credits up to $7,500 are available. Electric Vehicle Tax Credit By Manufacturer.

From newandroidcollections.blogspot.com

Electric Car Credit Limit How The Electric Car Tax Credit Works Electric Vehicle Tax Credit By Manufacturer Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. The inflation reduction act of 2022 (ira) makes several changes to the tax. Electric Vehicle Tax Credit By Manufacturer.

From www.youtube.com

The Electric Vehicle Tax Credit Explained YouTube Electric Vehicle Tax Credit By Manufacturer On april 17, 2023, the irs published a notice of proposed rulemaking requiring that, to qualify for half of the $7,500 section 30d clean vehicle tax. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit. The inflation reduction act of 2022 (ira) makes. Electric Vehicle Tax Credit By Manufacturer.